MBX Biosciences Case Study

An IPO can be a long, demanding and complicated process that will have long term implications for your company. Our IPO solutions and experts help you successfully navigate the intricacies and prepare for life as a public company. Are you ready?

When it comes to capitalizing on key moments in the IPO process, DFIN leads the way – and we have the numbers to prove it.

Over the last eight years, DFIN

Filed

800+

IPOs

Partnered on

70%

IPOs valued at

$100M+

Serviced

~60

IPOs valued at

$1B+

Supported

Majority of PE and VC-backed IPOs

Considerations for Business Owners and Executives Taking Their Company Public

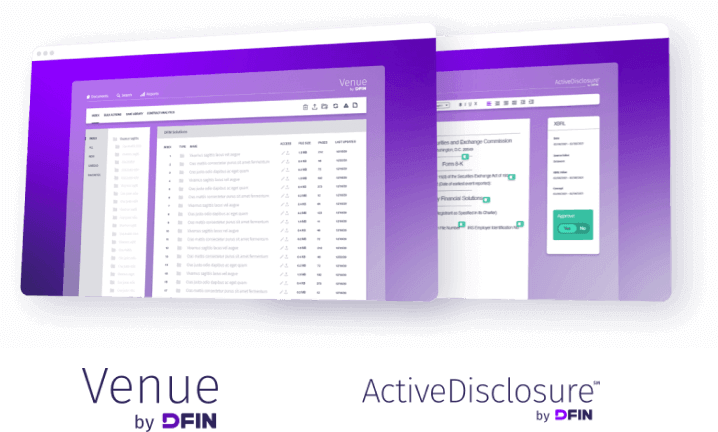

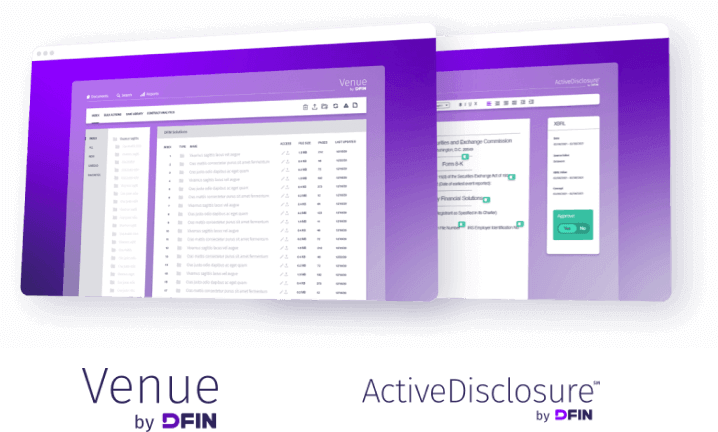

Download IPO guideTake the complexities out of compliance for financial, legal, and investors teams.

Share sensitive information across teams and stakeholders worry-free.

IPO Timeline

Preparation

Pre-Filing

Initial submission of S-1

Roadshow

Pricing/Trading

Life Post IPO

IPO Timeline

12 - 18 Months

4 - 6 Months

3 Months

2 Weeks

Trade date

Regulatory Compliance and Reporting

How we helped a pharma company capitalize on IPO market conditions and timing

How we helped a healthcare company get and stay deal ready to go public and close a secondary offering

Execute a successful IPO with management and staff working from secluded locations

How we helped an electric vehicle company save time and money before and after going public

How we helped a leading enterprise finance management company streamline its IPO process

Get in touch with us for IPO support, pricing or more information.

or

call +1 866 784 9840

Despite entering Q2 with strong financials and compelling growth narratives, many companies chose to delay IPO plans amid persistent market volatility. However, a few standout issuers—such as Circle Internet—moved forward, drawing robust investor interest and signaling selective confidence in the public markets. Several significant filings at quarter-end have renewed optimism that the IPO window is reopening."

Craig Clay, President of Global Capital Markets, DFIN