On August 26th, the SEC modernized its disclosure rules under Regulation S-K. Arguably the most dramatic change is that companies are now required to disclose information about their environmental practices and their human capital resources to the extent that these are material to a company’s business as a whole.

Board Oversight of Risk

This article was originally posted on Equilar.

The recent 2020 proxy season occurred during the expanding coronavirus (COVID-19) pandemic, the full outcomes and impacts of which aren’t fully known as of this writing.

Industry Roundtable: LIBOR Transition: Lessons Learned and Strategies Going Forward

With the end of LIBOR fast approaching, many organizations are struggling to find an efficient way to manage the transition. eBrevia hosted a roundtable discussion with senior leaders from PwC and Norton Rose Fulbright to discuss key insights learned from managing the LIBOR transition to date and strategies to complete LIBOR remediation on time.

Speakers: Davide Barzilai, Partner, Norton Rose Fulbright & Sally Neal, Retired Partner, PwC

Moderator: Adam Nguyen, Co-Founder and Senior Vice President, eBrevia, a DFIN Company

SEC OKs Apps to Deliver Summary Prospectuses for Variable Products

DFIN Input to Rule 498A Could Open the Door to Apps Industry-wide

When rule 30e-3 (also known as the E-Delivery Rule) came into effect, DFIN applauded the cautious step forward but encouraged the SEC to accelerate the wide adoption of modern technology (Read more at Looking Beyond the SEC’s New E-Delivery Rule).

How Smarter Redaction is Transforming Due Diligence. For the Better.

Recently, a surge in AI-powered virtual data rooms (VDRs) have proved helpful in optimizing due diligence tasks like redaction. Data redaction tools have emerged to remove key terms quickly and relatively easily, saving sellers time and energy. Where these tools fall short, however, is in their ability to eliminate much of the manual effort still needed to structure and guide how information is redacted.

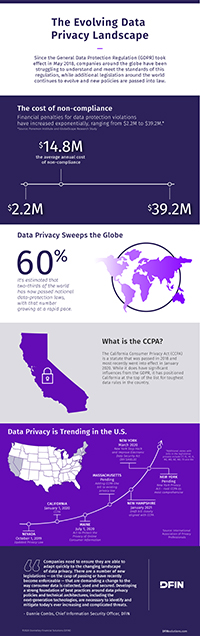

Data Protection in Transition: GDPR, CCPA and Comparable Data Protection Laws

What Are Virtual Data Rooms Used For?

Control and security

Most of us are familiar with file sharing sites, having used them in our personal lives.

These services allow users to create, store and share files in a cloud-based repository that syncs in real-time across all devices. Users have some control over who can access, share, download and edit files, but that’s mostly where the control starts and stops.

The Top 5 Benefits Of Virtual Data Rooms

The benefits of a virtual data room (VDR) aren’t new to dealmakers. When it comes to promoting company interests, VDRs are an efficient, cost-effective and strategic way for buyers and sellers to not only cross the finish line, but to win.

Expanding Use of AI in Bank Operations: AI Document Information Extraction & Chatbot Lets Bank Staff Handle Specialized Tasks

A growing number of banks in Japan are moving to improve the efficiency of their operations by using artificial intelligence (AI). Recently, Mitsubishi UFJ Trust and Banking Corporation (MUTB) developed an AI solution that can import an enormous number of documents, including contracts, class action complaints and mutual fund prospectuses, and automatically extract only the information needed by clients. The bank will implement a system using this technology in 2019 that will allow it to reduce the time spent on a variety of internal operations by 5,000 hours annually.

Same Battle, Different Field: A Conversation With Our Chief Information Security Officer

For almost a decade, Dannie Combs’ day-to-day decisions had life-or-death implications. In his role with the United States Air Force, Combs managed cybersecurity operations and information risk activities for military and governmental organizations as a member of the North American Aerospace Defense Command, National Security Agency, Air Intelligence Agency, and more, participating in missions ranging from homeland defense to offensive operations around the world.