For years, organizations have touted their sustainability and corporate social responsibility efforts in voluntary reports. Increasingly, though, company stakeholders are demanding more accurate and transparent Environmental, Social, and Governance (ESG) data.

Both retail and institutional investors, for example, are focused on the intersection of ESG data and business growth, recognizing that a company’s commitment to ESG can signal both future opportunities and risks. To investors, strong ESG performance suggests that a company is not only responsibly managing its environmental impact, social responsibilities, and governance practices, but is also positioning itself for long-term success. Companies with robust sustainability practices are viewed as lower-risk, forward-thinking investments that are better prepared to navigate future challenges and drive value.

Regulators are also emphasizing ESG performance, pushing companies to enhance transparency around ESG by mandating compliance and disclosure requirements. In March 2024, the U.S. SEC introduced long-awaited climate disclosure mandates—a major win for climate advocates; however, the mandates were quickly paused due to legal challenges, giving some companies additional time to strengthen their ESG programs. Despite this, U.S. companies operating in the EU and other regions remain obligated to meet stringent international reporting requirements.

Most recently, Governor Gavin Newsom of California signed Senate Bill 219 (SB-219) into law, mandating all U.S. companies doing business in the State of California that meet certain financial thresholds to report on greenhouse gas (GHG) emissions and climate-related financial risks.

It is estimated that SB-219 will affect over 10,000 large businesses today. However, far more small and medium-sized value-chain businesses will also be impacted and required to report climate-related information.

Leading the Charge

As ESG becomes increasingly vital to long-term business strategy, companies are stepping up to meet investor and regulatory demands for transparency and accountability.

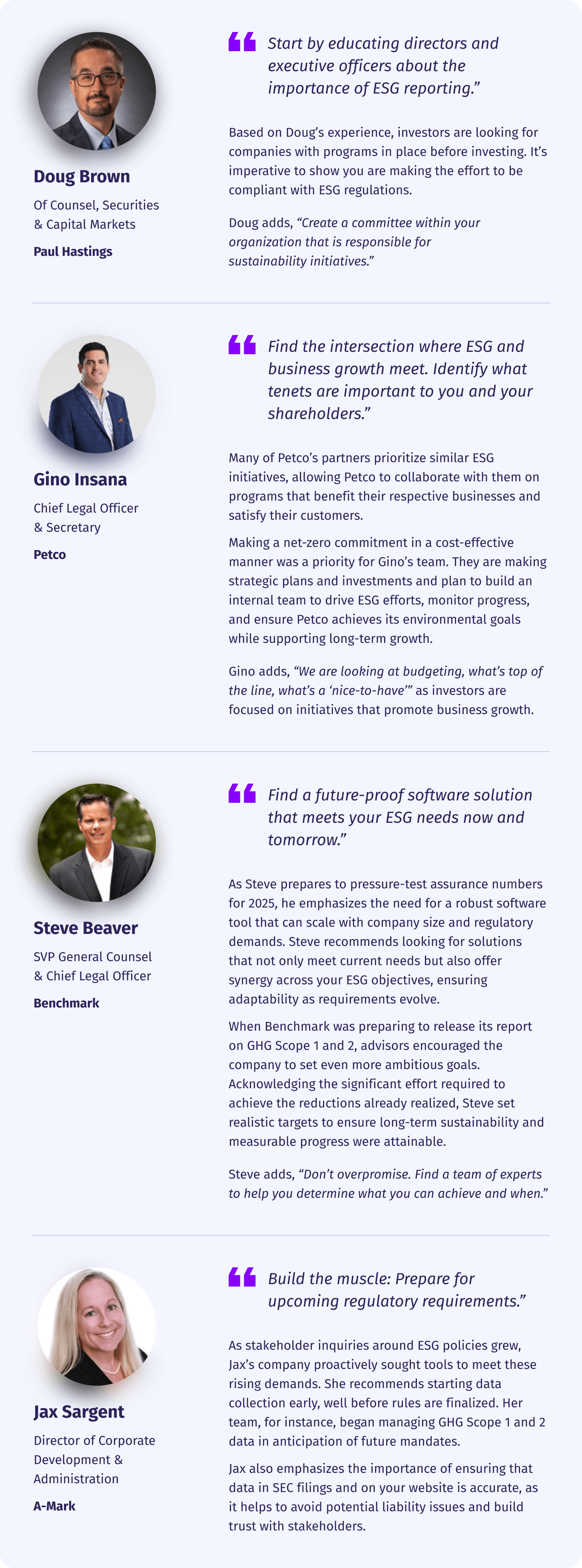

At DFIN’s second annual Activate Executive Summit, I sat down with a panel of ESG leaders who shared best practices and actionable insights on how to build impactful programs that foster trust and compliance.

Here’s what's top of mind for business executives leading the charge for ESG at their companies, and how DFIN can help meet those challenges.

ActiveDisclosure for ESG

DFIN’s ActiveDisclosure for ESG Reporting, paired with our expert advisory and consulting services, helps forward-thinking business leaders navigate the complexities of ESG reporting and meet the rising demands from investors and regulators. The purpose-built platform streamlines data collection and drives efficiency through real-time collaboration, enabling teams to work together seamlessly within a single system.

By centralizing data, organizations ensure their ESG data is accurate, reliable, and submitted to stakeholders promptly.

As regulations evolve into mandates, ActiveDisclosure adapts by incorporating new compliance processes, ensuring teams can appropriately tag data according to the latest requirements. DFIN's ESG reporting capabilities include:

- Collection, calculation, and reporting of GHG data across Scopes 1, 2, and 3

- End-to-end carbon accounting and reporting functionalities

- Comprehensive reporting to the SEC for both financial and ESG disclosures

Additionally, DFIN's experts also assist companies in understanding changing global regulations (including the EU's CSRD and California's SB-219), and in creating reports that align with requirements across various regulatory jurisdictions.

As a leader in inline XBRL, DFIN embraces current and future standards. Many regulatory bodies are adopting inline XBRL as the standard language for business reporting, enhancing the usability, consistency, and comparability of ESG data across organizations and industries.

Companies that build thoughtful ESG and sustainability reporting practices with DFIN and ActiveDisclosure are better positioned as regulations change and investor demands increase. By leveraging these resources, organizations can seamlessly integrate robust ESG practices, staying ahead in the rapidly evolving sustainability landscape.

For more insights, watch the full ESG Panel. You can also view DFIN’s latest ESG Webinar: A Rational & Affordable Solution to ESG and Sustainability Excellence.