As we reflect on 2023 and look toward 2024, it’s clear that the fintech industry is experiencing an unprecedented period of change in terms of regulatory proposals, technology and data. In this article, Eric Johnson, DFIN’s president of Global Investment Companies, shares his view on the key factors shaping the industry now.

SEC regulations and the rise of structured data

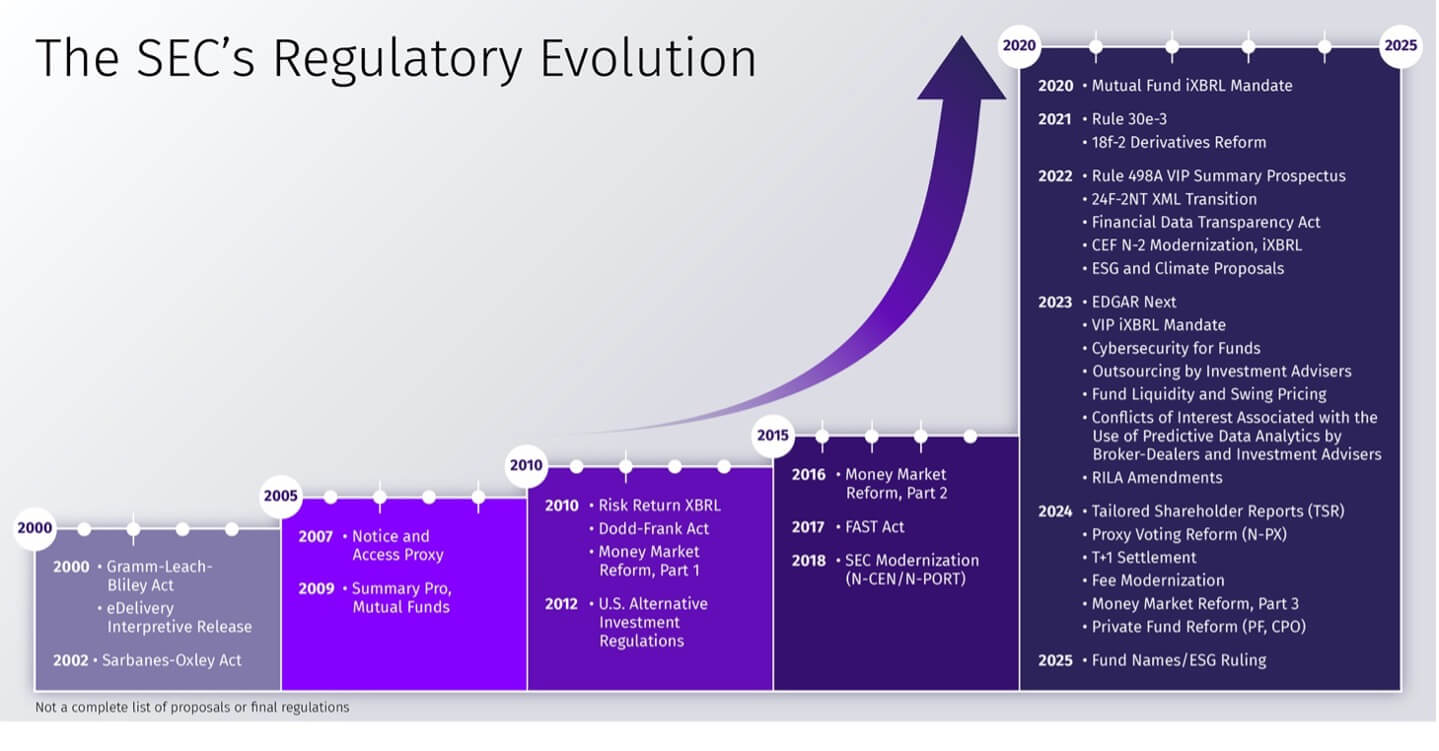

During the last few years, we’ve seen both the volume and the pace of SEC regulations increase exponentially, with no slowdown in the immediate future.

During the last 2½ years, there have been more than 50 SEC proposals or final rulings. From May to July of 2024 alone, four major rules will go into effect in what could be called a grand slam summer: Tailored Shareholder Reports Ruling; Money Market Reform, Part 3; Proxy Voting Record; and the T+1 (Shortened Securities Transaction Settlement Cycle).

These rulings all reflect the increased movement toward more structured data, allowing the SEC to mine data and more accurately predict market events in times of stress. They’ve been created to drive greater transparency and better monitoring by the SEC to protect the end investor, providing an enhanced investor experience.

With the current pace of SEC regulations, there is a balance between providing prescriptive and principal-based goals. There are naturally more questions with principal-based direction, which provides guidance while allowing for flexibility as technology changes. Many clients are preferring more prescriptive direction, which is easier to interpret and therefore implement.

However, we’ve heard that when this much regulation is happening, firms tend to react to what regulators are telling them to do and innovate less. This can significantly impact budgets and make innovation a lower priority.

On the horizon

Other noteworthy proposals being considered will originate from both the SEC and Department of Justice.

Certainly the ESG and Climate debate shows no sign of slowing down, with the recent passing of the Investment Company Final Ruling. We await the pending approval of the ESG and Climate Proposals, which will impact investment and public companies through substantial disclosure changes and iXBRL tagging requirements.

The Department of Justice’s Compliance Website Accessibility Mandate will explicitly require federal, state and local government websites to conform to WCAG 2.1 AA. Once enacted, we can expect public companies to adapt to the new standards.

Lastly, we believe EDGAR Filer Access and Account Management (aka EDGAR Next) will transform the filing process by implementing an account administrator system dashboard to manage accounts and offering APIs for system-to-system authentication and filing.

DFIN supports EDGAR Next as a meaningful response to the ongoing need for heightened security. What’s more, the SEC has continually refined EDGAR Next by listening to user feedback. DFIN has been actively involved in both the user account dashboard beta and API beta testing programs. We are providing a comment letter to help guide the final ruling and will be ready to update our systems to accommodate the increased administrative requirements.

The Cybersecurity Risk Management Proposal will require advisers and funds to adopt and implement written policies and procedures that are reasonably designed to address cybersecurity risks. The proposal has been created to enhance adviser and fund disclosures related to cybersecurity risks and incidents as well as require timely reports of a cyber incident.

This proposal supports the SEC crackdown on "off channel communications" such as text messages and encrypted messaging apps that are not part of a firm’s official recordkeeping.

We’re also keeping a close eye on AI enhanced regulations as well as initiatives in data tagging. Tagging in the document creation system ensures data integrity across the various outputs and automates proofing checks. As compliance dates become increasingly compressed, the single source approach in tagging and producing many outputs, such as iXBRL, EDGAR, HTML and accessible PDFs, can aid in streamlining the review process and ensuring accuracy.

The long-game strategy: preparation, process and partnership

A common theme heard at the recent ICI Conference was the emphasis on change. During the session on Tailored Shareholder Reports, moderator Jason Nagler called the ruling a huge process change and an opportunity for companies to look at their operating models and make them better.

At DFIN, we believe that putting the right strategic decision-making in place now will put our clients in a better position to handle increasingly complex regulations down the road. There are valuable benefits to having a partner who understands the regulations, and understands a firm’s workflow and document needs — as well as internal client operations — working as an extension of the internal team.

In an evolving regulatory climate like the one we’re in now, there's an increasing need for this level of service. We’re seeing more reliance on the DFIN service team, from helping maintain a Regulatory Book of Record (RBOR) to providing a trusted, end-to-end, integrated solution.

More than ever, the combination of domain knowledge, account familiarity, technological expertise and SEC experience is a competitive advantage.

As markets fluctuate, regulations evolve and technology advances, financial firms need solutions that will ensure compliance at every level. DFIN’s cloud-based Arc Suite is the industry’s leading end-to-end platform, offering regulatory, reporting, legal, filing and distribution solutions.