How We Helped a Private Biotech Company Prepare for Fundraising & Growth

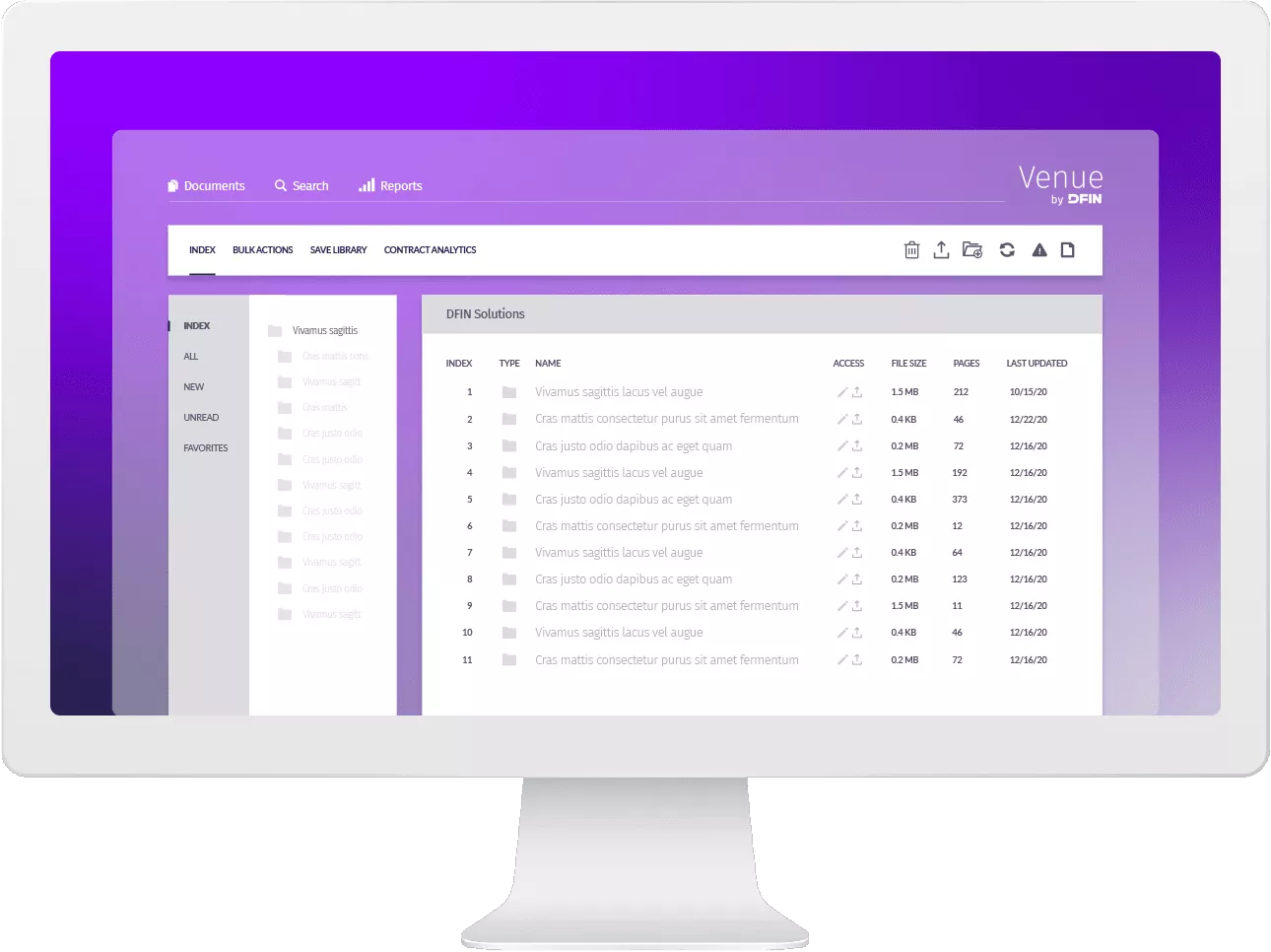

Our intuitive virtual data room platform is continually optimized for security, productivity and usability. Venue VDRs are reinforced by experts who leverage our more than 30 years of experience in the financial sector.

Book a demo

100%

of the Top 100 investment banks

100%

of the Top 100 private equity firms

80%

of IPOs over $250M

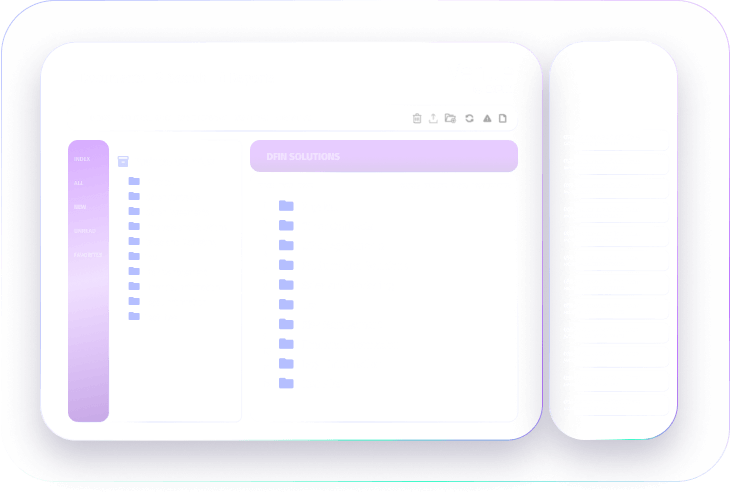

Multi-file Redaction

Easy Setup

Security

Reporting & Analytics

Power a More Efficient Workflow

How We Helped a Global Investment Bank Drive Secure Collaborations & Data Sharing Worldwide

How we helped a healthcare company get and stay deal ready to go public and close a secondary offering

How Venue’s high security and collaborative design delivered for biopharma

How Venue provided speed and security to a mid-tier U.S. mining company’s sales process

15 minutes is plenty of time to see if Venue is a fit for your team

or

call +1 866 245 6044

Floyd Strimling, Chief Product Officer at DFIN, sits down with Dana Barrett to discuss responsible AI in financial reporting.

Venue virtual deal rooms accelerate critical business moments securely. The DFIN Information Security Program helps to ensure data protection, enterprise cybersecurity and supply chain security using multiple standards, including:

SOC 2 Type II Audits

HITRUST Audits Reports

ISO/IEC 27001:2013 Certification

MFA & SSO Integration

AES 256-bit Encryption at Rest & in Transit

3rd Party Penetration Testing

Role-based Access Control (RBAC)

Intrusion Prevention (IPS) and Detection (IDS) Systems

Our SMEs ensure accuracy and lower risk with error-free file structuring and permissions. You focus on the deal, and we’ll manage the rest.

![]() Regionally assigned project manager providing end-to-end guidance.

Regionally assigned project manager providing end-to-end guidance.

![]() 24/7/365 support from experts around the globe.

24/7/365 support from experts around the globe.

![]() Trusted by Fortune 1,000 companies, start-ups, investment banks, PE firms and more.

Trusted by Fortune 1,000 companies, start-ups, investment banks, PE firms and more.

Accelerate your IPO process with our leading-edge technology-based software and expertise. Our experts will help you successfully navigate deal execution intricacies, maximize value and prepare for life as a public company.

Our leading experts and software solutions accelerate due diligence, deal closing and post-merger integration, helping you to drive your M&A deal forward and maximize deal value.

Take the complexities out of regulatory reporting. Seamless integration, simple onboarding, Microsoft Office compatibility and all the tools you need for fast, secure filings.